Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Forex trading is a profitable venture that any Singaporean can engage in, either part-time or full-time. But, to reap maximum returns, you must educate yourself and trade with a good platform. Finding a forex platform Singapore can be challenging since many service providers are available in this region. But don’t worry, we are here to help with that.

Our seasoned gurus researched, vetted, and selected the best forex brokers in Singapore. We’ve reviewed them in this comprehensive guide, alongside their pros and cons. With the insights outlined here, you will be better positioned to choose a trading platform that can fuel your journey to becoming a profitable forex trader.

In a Nutshell

- Despite being risky, forex trading can be a lucrative venture. But you need an excellent broker to attain maximum success.

- Picking an excellent trading platform in Singapore is challenging since many options are available.

- We’ve made the selection process easier by evaluating forex brokers that accept Singaporeans and selecting 5 pace setters.

- While searching for the best forex brokers in Singapore, our experts considered numerous factors, including licensing, fees, and financial instruments.

- The platforms recommended in this guide are regulated by numerous authorities, including the MAS, which authorises and monitors brokers operating in Singapore.

List of the Best Forex Brokers in Singapore

- Pepperstone – Best Overall Forex Broker in Singapore

- AvaTrade – Best Forex Broker for Beginners in Singapore

- Plus500* – Best for Broker for CFD Traders in Singapore

- eToro – Best Forex Broker for Portfolio Diversification

- FP Markets – Best Broker for Professional Forex Traders

Note: 80% of retail investor accounts lose money when trading CFDs with this provider. This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorised by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe such as leverage limitations and bonus restrictions.

Compare Forex Trading Platforms in Singapore

Innumerable forex trading platforms accept Singaporeans. That raises one crucial question: how did we pick the best brokers in Singapore from the available multitude? The answer is simple. We conducted extensive online research and identified a handful of the most reputable companies in Singapore. Then, our experts evaluated these brokers, pitched them against each other, and hand-picked 5 that are a cut above the rest.

While evaluating and comparing the forex trading platforms in Singapore, we kept numerous factors in mind, from licensing and regulatory status to customer support availability and supported payment methods. We also ranked the selected brokers based on their ratings and reviews on popular platforms like Google Play, the App Store, and Trustpilot. You should do the same when looking for the best forex trading platform Singapore.

Here’s a quick rundown of the primary factors we considered while evaluating brokers and picking the best service providers in Singapore.

| Best Forex Broker Singapore | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | MAS, FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin, | 24/5 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| AvaTrade | MAS, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Plus500* | MAS, FSCA, CySEC (#250/14), FCA, ASIC, | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| eToro | MAS, FCA, CySEC, FSCAASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit card, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| FP Markets | MAS, FCA, FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Debit/credit card, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

Note: 80% of retail investor accounts lose money when trading CFDs with this provider. This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorised by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe such as leverage limitations and bonus restrictions.

Brokers Overview

A trader’s primary goal is to reap profits from financial markets. That said, several elements can eat away at your profitability, with fees at the top of the list. To maximise returns, you must trade with a service provider with affordable costs. Additionally, ensure your chosen broker offers the financial instruments you prefer before signing up. Otherwise, you’ll waste valuable time and get disappointed in the future.

Considering what we’ve discussed, use the table below to identify the best forex broker Singapore based on fees and assets.

Fees

| Best Forex Broker Singapore | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of inactivity |

| Plus500* (CFDs) | $100 | From 0% | Free | $10 monthly |

| eToro | $50 | From 0% | $5 withdrawal fee | $10 monthly |

| FP Markets | $100 | From 0.0 pips | Free | $0 |

Note: 80% of retail investor accounts lose money when trading CFDs with this provider. This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorised by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe such as leverage limitations and bonus restrictions.

Assets

| Best Forex Broker Singapore | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* | Yes | Yes | No | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Note: 80% of retail investor accounts lose money when trading CFDs with this provider. This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorised by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe such as leverage limitations and bonus restrictions.

Our Opinion about Forex Trading Platforms in Singapore

After spending many days researching and analysing these platforms, we’ve shared our opinions and reviews of the best forex brokers in Singapore. We always test every service provider with both demo and live accounts before featuring it in our guide. Everything we say and recommend stems from extensive research and first-hand experience.

Here are detailed overviews of the best trading platforms in Singapore.

1. Pepperstone – Best Overall Forex Broker in Singapore

Pepperstone was founded in 2010 and boasts hundreds of thousands of users. We’ve ranked it the best overall forex platform Singapore for various reasons. To begin with, Pepperstone offers traders access to over 90 FX pairs. They range from majors and minors to exotics, NDFs, and crosses. As a Singaporean, you can trade everything from AUD/SGD and CAD/SGD to EUR/SGD and CHF/SGD.

We also recommend Pepperstone to Singaporeans because this forex broker offers a broad range of trading platforms. You can trade with the proprietary Pepperstone Trading Platform or download the broker’s dedicated mobile app for trading on the go. Additionally, as a Pepperstone client, you get uncapped access to TradingView, cTrader, and MT4/5.

Finally, Pepperstone is an outstanding broker that has zero minimum deposit requirements, cost-free transactions, and no inactivity fees. That makes it an ideal choice, even for low-budget traders.

Pros

- No minimum deposit requirement

- Cost-free deposits and withdrawals

- Zero inactivity fees

- Hosts third-party software like MT4 and MT5

- Low spread starting from 0.0 pips

Cons

- Product offerings are limited to FX pairs and CFDs

- Fewer educational tools compared to other industry leaders

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. AvaTrade – Best Forex Broker for Beginners in Singapore

Suppose you’re new to forex trading. AvaTrade is here to help you kick your career into high gear. This broker is dedicated to providing all the materials and tools that novice forex traders need. We visited its Educational Center and were impressed by the wide variety of resources offered there, from basic articles to advanced tutorials.

AvaTrade also offers Ava Academy to Singaporeans who are starting out in the forex trading scene. This platform has comprehensive courses that don’t cost a dime. You can use them to master the fundamentals of forex trading, craft the most effective strategies, and learn to manage risk effectively. After acquiring sufficient knowledge, you can use an AvaTrade demo account to test yourself and hone your skills through constant practice.

Pros

- Premier educational tools and materials

- Simple, beginner-friendly user interface

- World-class customer support

- Provides third-party platforms like MT4 and MT5

- Zero deposit and withdrawal fees

Cons

- Limited financial instruments compared to its peers

- Higher spreads than other industry leaders

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

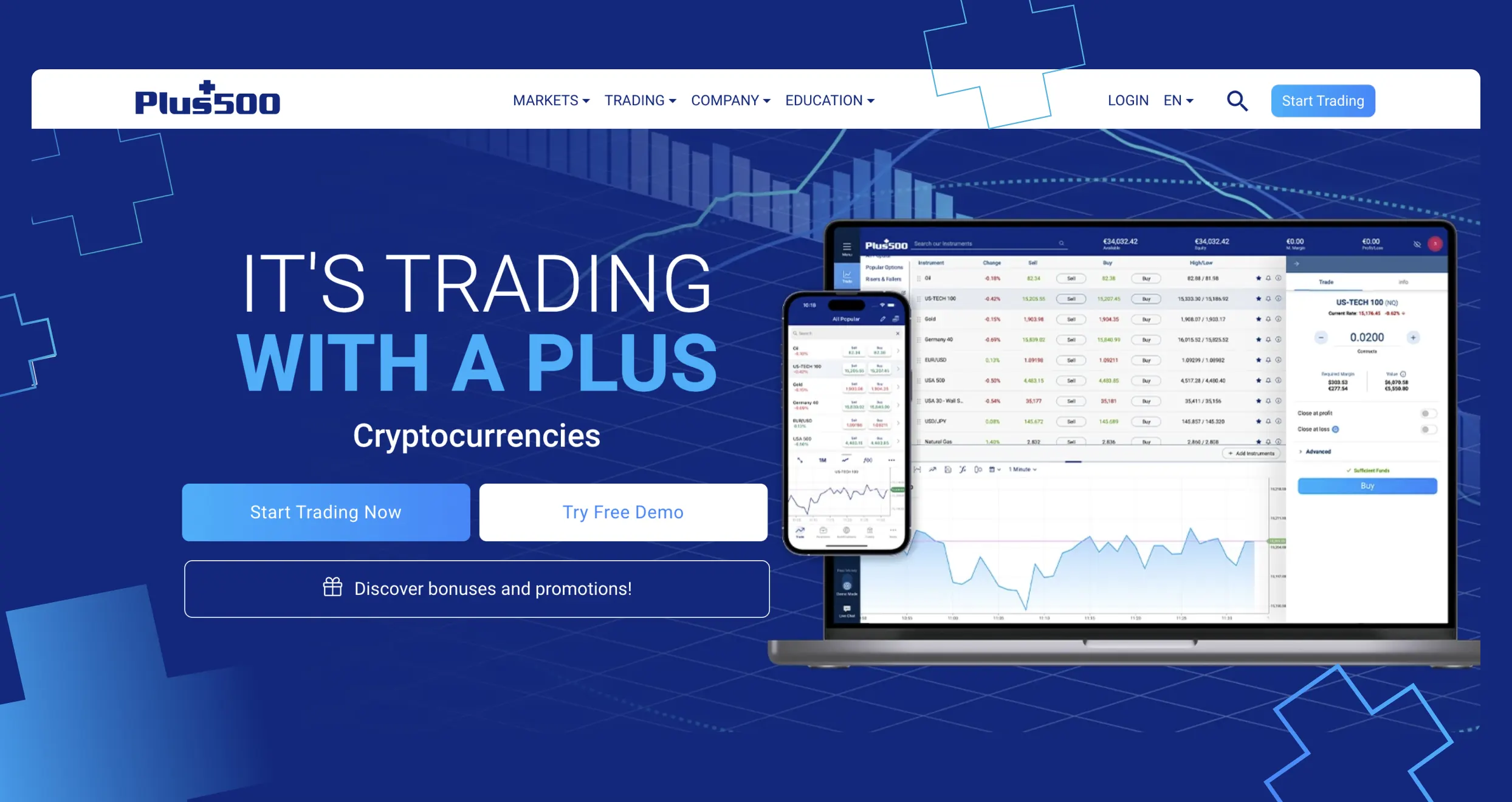

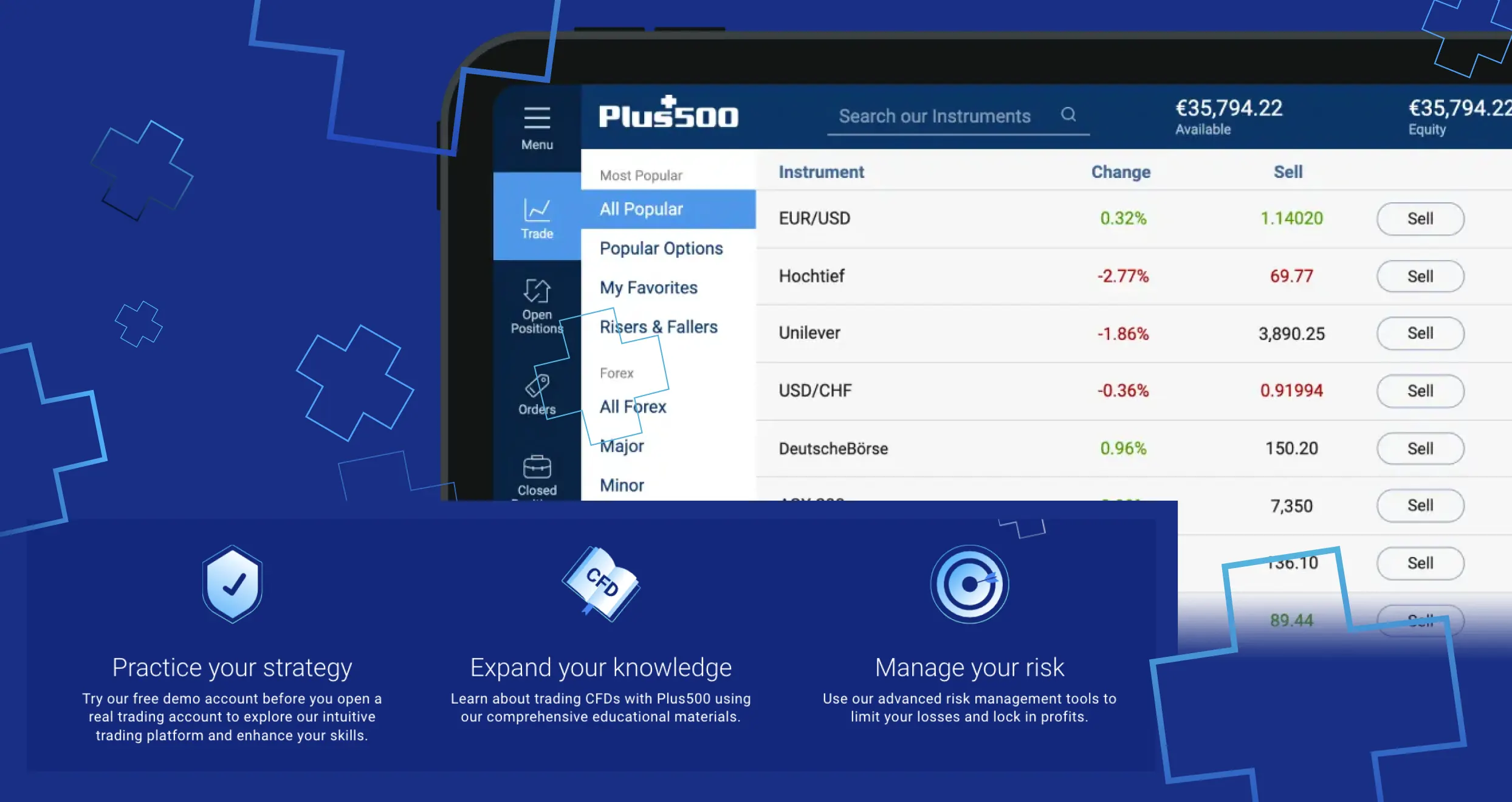

3. Plus500 – Best for Broker for CFD Traders in Singapore

CFD trading makes it possible for traders like yourself to speculate on the price movements of different FX pairs without purchasing the underlying assets. If you are interested in this endeavour, we recommend Plus500. With this broker, you can trade CFD on over 60 currency pairs, from USD/SGD and AUD/SGD to GBP/SGD and EUR/SGD.

We also urge CFD traders to try Plus500 since it has some of the friendliest spreads. You can trade CFDs on popular pairs like EUR/USD and enjoy spreads as low as 0.00014 pips. This broker also helps you reduce expenses through free deposits and withdrawals.

In addition to currency pairs, Plus500 allows users to trade CFDs on stocks, commodities, indices, and more. This means diversifying your portfolio will be relatively easy when trading with this service provider. Note, Plus500CY Ltd authorized & regulated by CySEC (#250/14).

Note: 80% of retail investor accounts lose money when trading CFDs with this provider. This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorised by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe such as leverage limitations and bonus restrictions.

Pros

- Exquisitely designed web platform and mobile app

- Low spreads starting from 0.0 pips

- No deposit or withdrawal fees

- Remarkable multilingual support service available 24/7

- Quality educational resources

Cons

- Exclusively offers CFDs in Singapore

- It doesn’t host third-party trading platforms like MT4/5

- $10 monthly inactivity fee

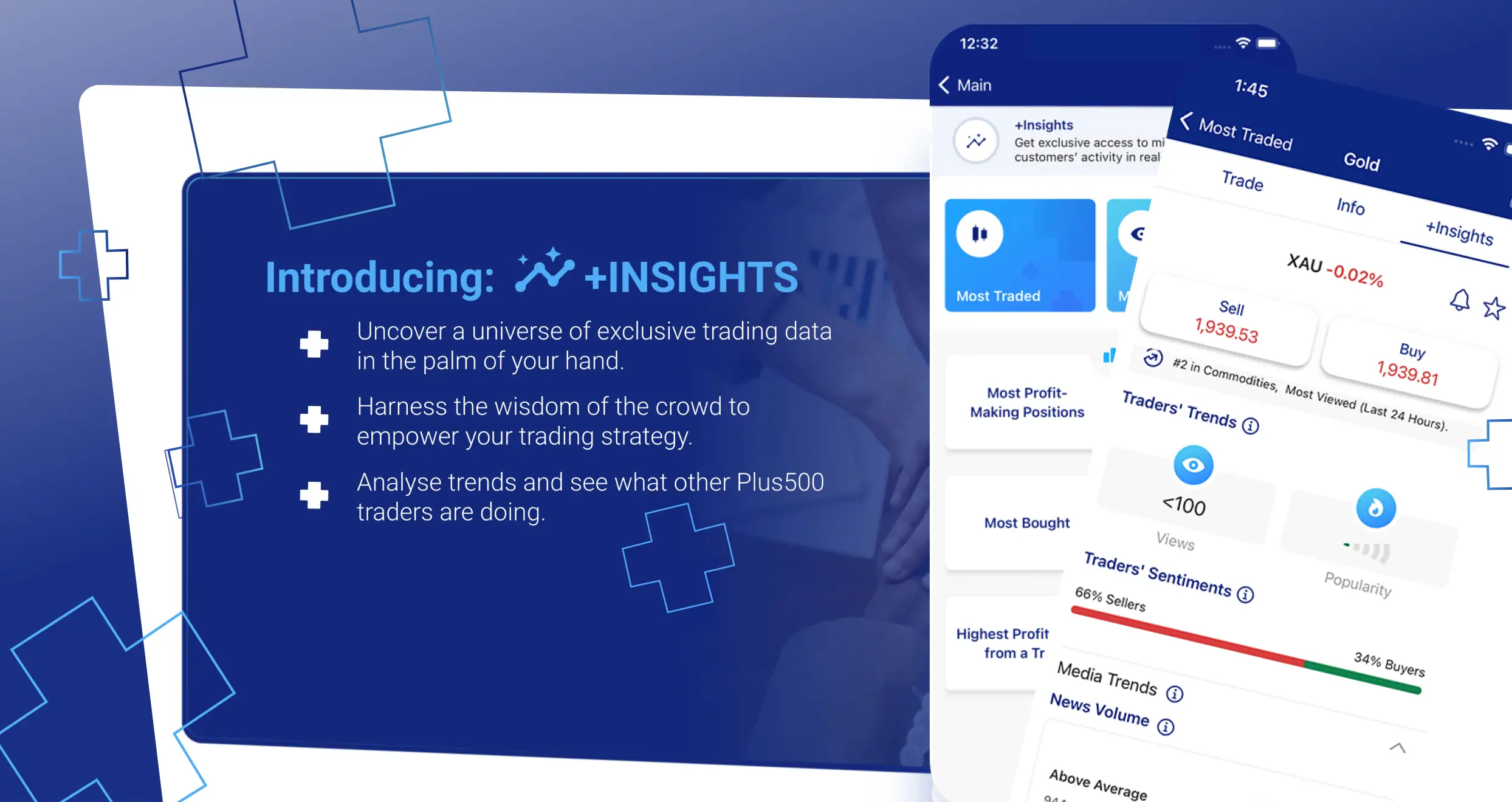

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy free deposits and zero internal withdrawal fees.

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. The good thing is this broker lets you choose between dynamic and fixed spreads. We preferred fixed spreads since they allowed us to minimize risk during high volatility periods, especially when we were trading with smaller stakes. But, if you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports commission-free trades.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

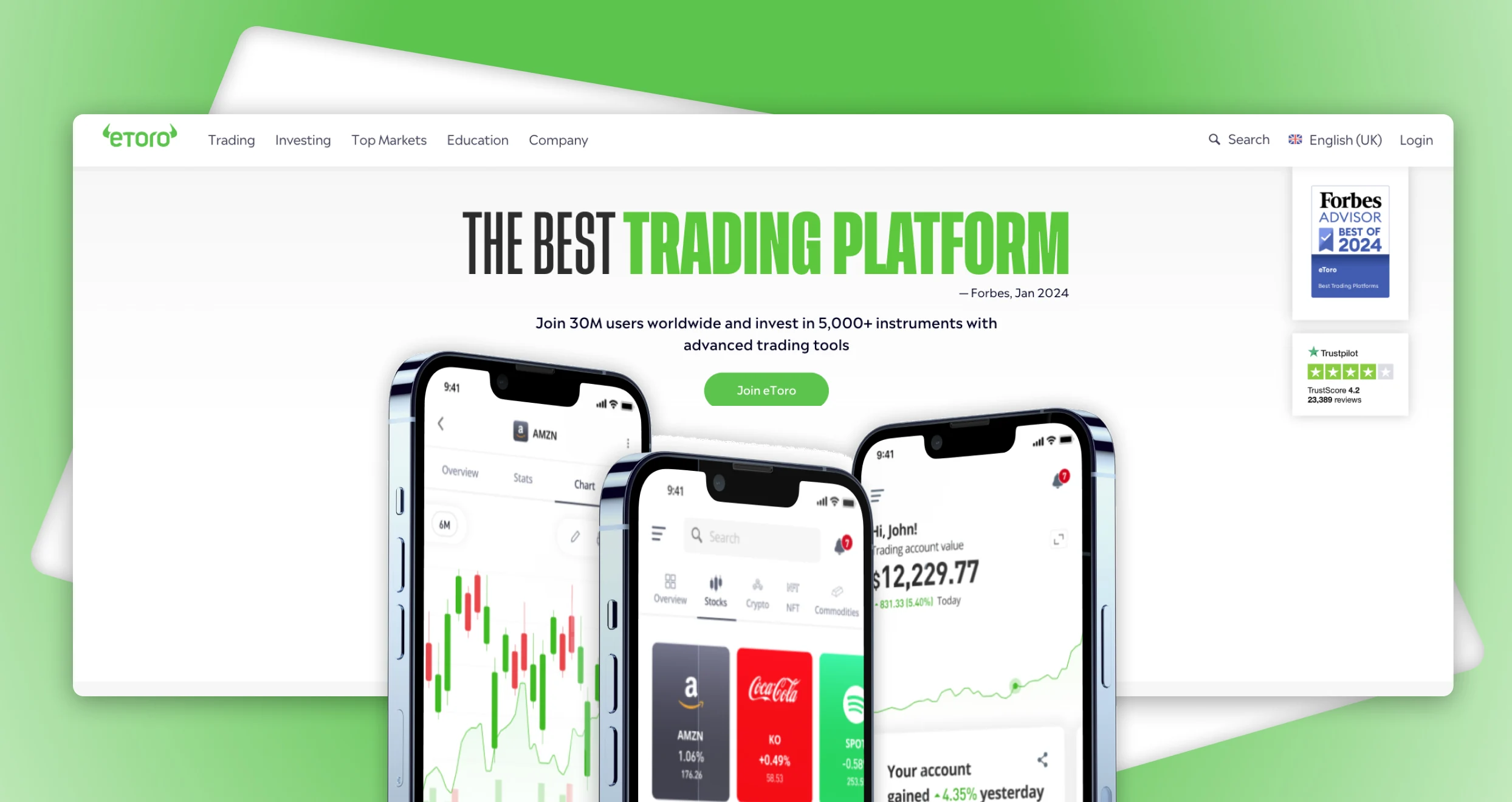

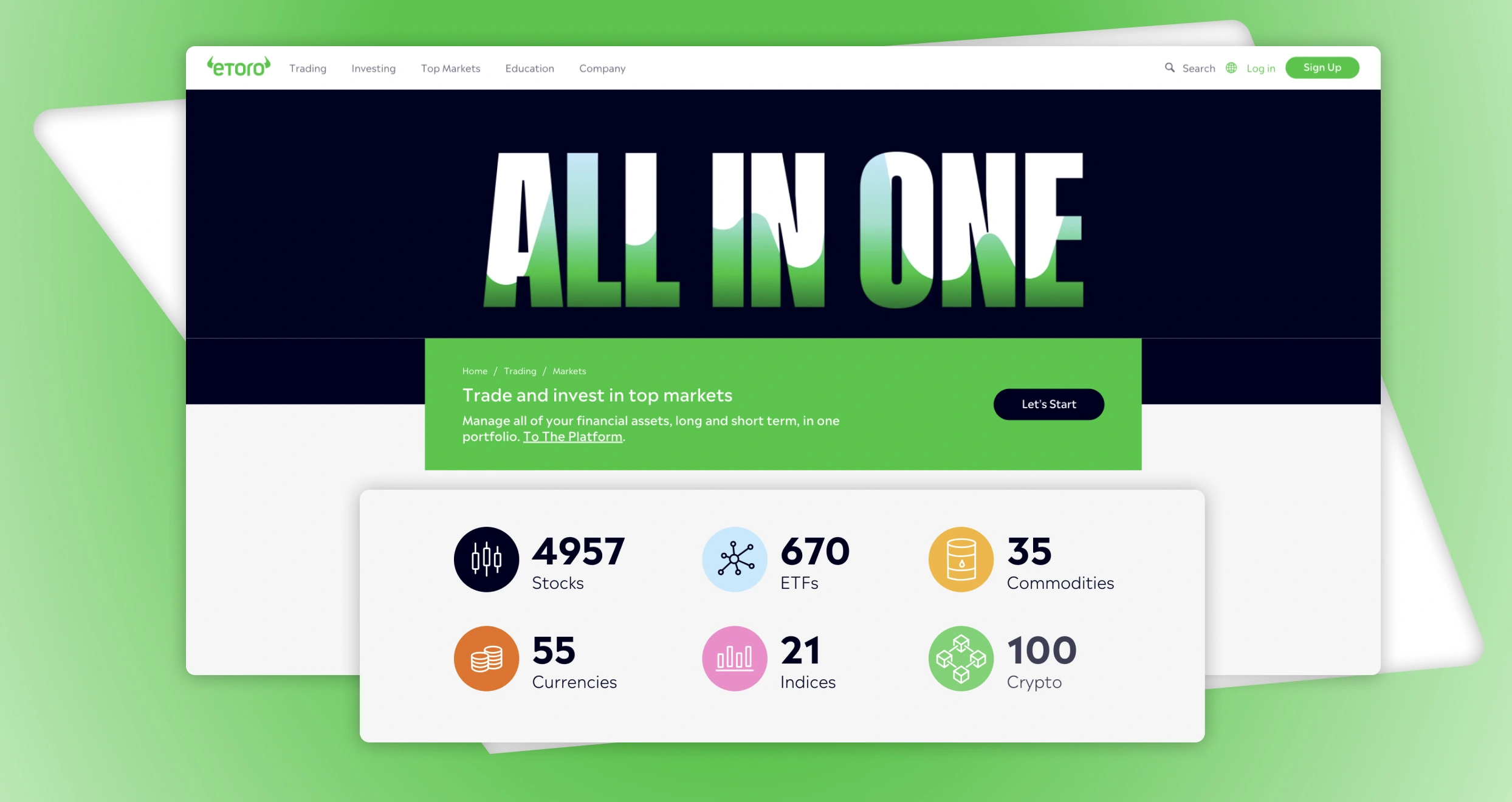

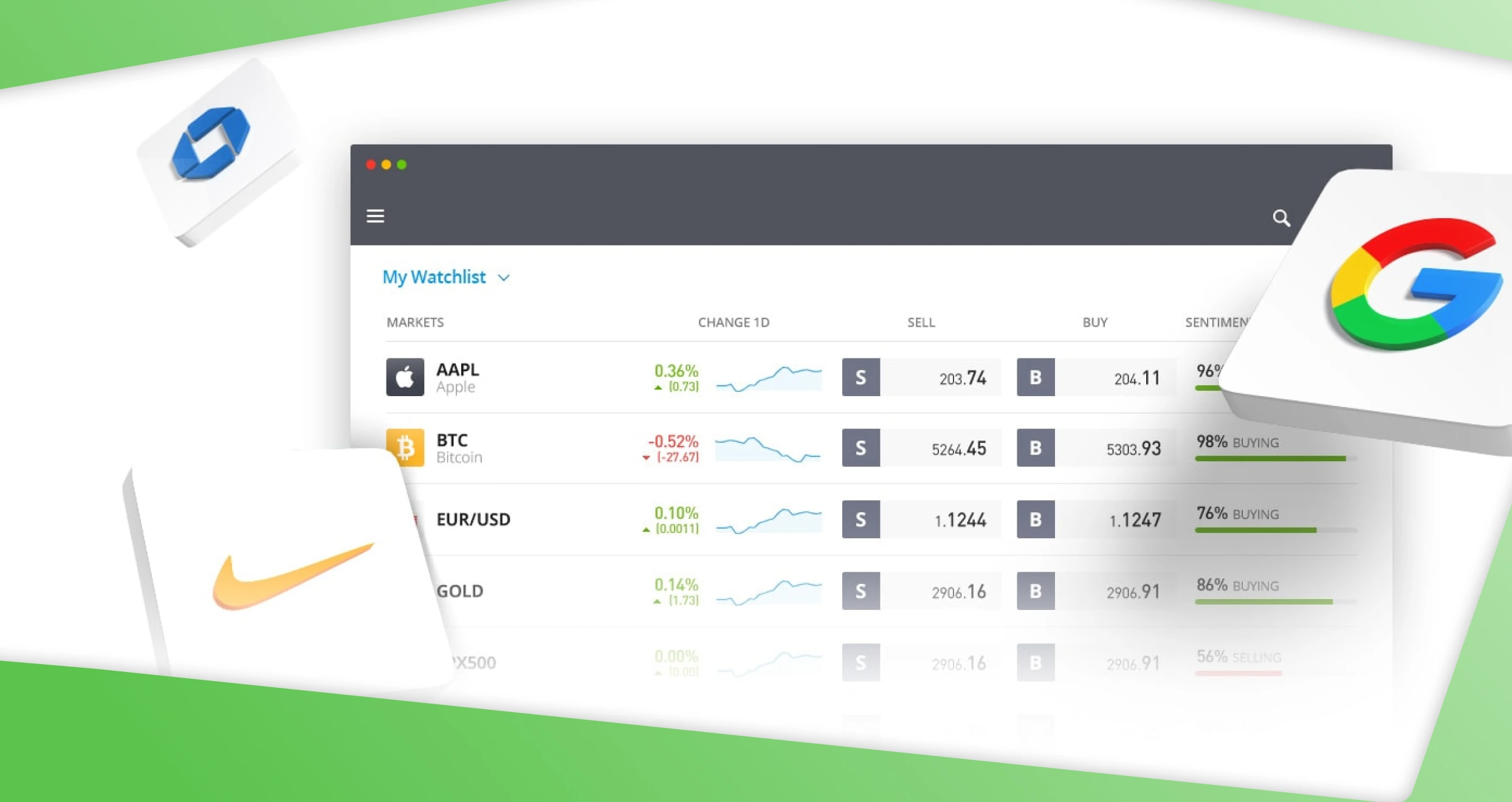

4. eToro – Best Forex Broker for Portfolio Diversification

Portfolio diversification is every successful trader’s holy grail. While investing in the forex market, you should always diversify and use different instruments to mitigate risk exposure. Otherwise, if you put all of your capital in one asset, things may go against you, causing disastrous financial losses.

Considering the above, eToro is the best broker for forex traders who value portfolio diversification. With an eToro account, you get access to over 40 tradable currency pairs. Additionally, you can hedge against risk by trading and investing in other assets, from crypto and real shares to CFDs on commodities, indices, and more.

The eToro trading platform is tailored for both novices and professionals. You can source indispensable risk management tips from the broker’s educational materials if you are still learning the basics. On the other hand, eToro offers news and analysis upd

Pros

- A broader range of instruments than its peers

- Provides premier research and analysis tools

- Offers free educational materials and a top-tier academy

- No deposit fees

- Easy-to-navigate user interface

Cons

- $5 fee for all withdrawal requests

- $10 monthly inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

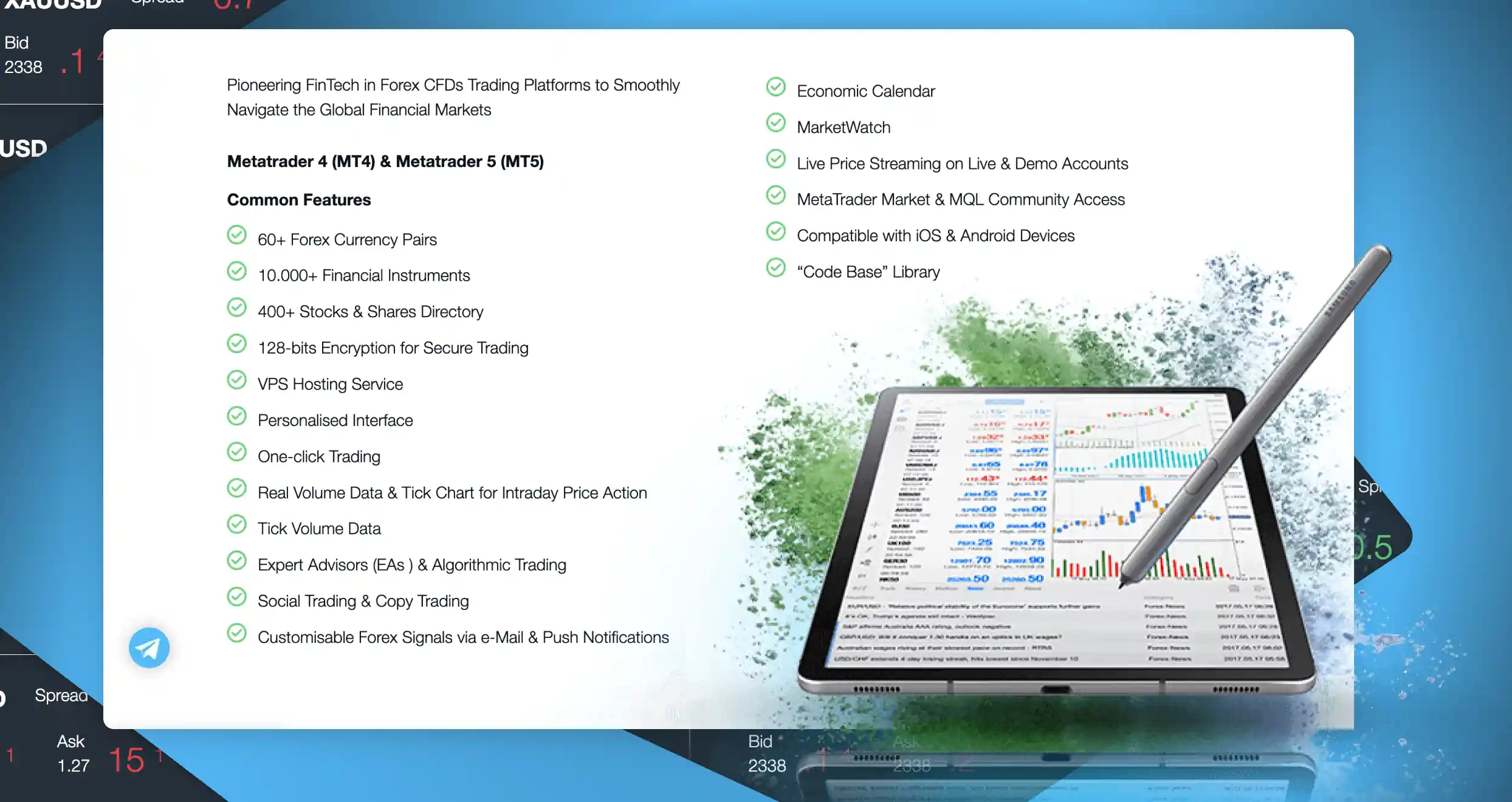

5. FP Markets – Best Broker for Professional Forex Traders

After analysing countless service providers, we believe FP Markets is the best broker for professional traders in Singapore. That is because it offers a wide variety of financial instruments, including over 70 currency pairs. While trading forex on this platform, professional traders can optimise their experiences with free deposits and low spreads starting from 0.0 pips.

Additionally, FP Markets has different types of trading accounts. As a guru, you can choose to trade with a standard or raw account. Both come with juicy features like flexible leverages of up to 500:1 for professional traders and Expert Advisors (EAs). You can also open a professional account, which comes with crucial features like negative balance protection and a dedicated personal account manager.

FP Markets is also ideal for professionals since it hosts a variety of coveted trading platforms, including cTrader, TradingView, and MetaTrader 4/5.

Pros

- Allows professionals to upgrade to special accounts with unique features

- Offers spreads as low as 0.0 pips to forex traders

- Hosts top-notch third-party trading platforms like MT4 and MT5

- No deposit and withdrawal fees

- Dormant accounts incur zero inactivity fees

- Provides 24/7 customer support

Cons

- Demanding eligibility requirements for professional accounts

- Iress has a $1,000 minimum deposit requirement

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

Forex Trading in Singapore

Forex trading is legal in Singapore. But this venture is strictly for Singaporeans aged 18 and above. Moreover, forex traders in this country are encouraged to interact with brokers licensed and regulated by the Monetary Authority of Singapore (MAS) for maximum security and safety.

If you are eligible, you can start trading FX pairs on your PC, tablet, or smartphone today. But note that the forex markets expose you to financial losses. Before diving in, budget wisely and learn how to mitigate risk exposure effectively. For instance, you can implement tools like stop-loss orders and limit yourself to risking less than 2% of your capital per trade.

Also, note that many fraudulent trading companies are targeting Singaporeans. To avoid dishing out your data and hard-earned cash to malicious actors, choose a broker to trade with carefully.

How to Choose the Right Forex Broker in SG

An intimidating number of forex brokers is available in Singapore. That can make picking the best trading platform incredibly challenging. But don’t give up yet. Use the tips outlined below to increase your chances of finding the most fitting service provider:

The first thing you should check while evaluating a forex broker is licensing and regulation. A multi-regulated broker follows strict rules and standards tailored to protect you against issues like financial fraud and data theft. Consequently, you should prioritise trading with a service provider that obeys regulations set by MAS and other authorities.

Before registering with a trading platform, check if it allows users like you to trade your favourite financial instruments. Furthermore, ensure you pick a broker with broad product offerings to facilitate seamless portfolio diversification.

Don’t sign up with a forex broker before going through the list of provided and hosted trading platforms. Additionally, look for a platform that aligns with your trading strategies and guarantees unquestionable stability. If you are a fan of third-party software like MetaTrader, ensure the broker you choose hosts such solutions.

Seasoned traders like us maximise profitability by trading with affordable brokers. You should follow suit since high costs erode your profit margins. While assessing a service provider’s affordability, check transaction costs, spreads, account maintenance fees, and other charges. They should be outlined in the broker’s fee structure.

You might encounter several challenges while navigating or trading with a specific broker. Also, you may need to ask a few questions or seek clarification where ambiguous mandates are involved. Such issues require prompt, expert assistance. Before committing to any service provider, check whether its customer support team is equipped to address any problems or concerns in good time.

You can assess the reputation of a forex broker through online ratings and reviews. While assessing if a service provider is perfect for you, visit Google Play, the App Store, and Trustpilot. On these platforms, you’ll find user feedback and testimonials regarding crucial aspects like the company’s ethics, dedication to solving customer issues, and transparency where fees are involved.

How To Register an Account with a Forex Broker SG

Don’t be intimidated by the account registration process. It may sound complicated, but it’s not. We registered with every broker reviewed here, and our accounts were good to go within a few minutes. Here’s how you can seamlessly open a forex trading account today:

Pick a service provider from our list of the best forex brokers in Singapore. Then, visit the company’s official site. Before registering, explore and check if the broker meets your expectations in terms of supported assets, trading platforms, fees, etc.

Click the sign-up, register, or join button to open your account. You can also install the provided mobile app from the official site and register with it. While setting up your account, provide authentic and accurate details like your name, email, and phone number. Furthermore, optimise the security of your account by setting a formidable password.

Filling out the application form isn’t the alpha and omega of account registration. Since these are regulated brokers, you must also undergo KYC verification. That requires you to share documents for verifying your identity and address. The former can be a national ID or driver’s license. On the other hand, you can use recent bank statements as proof of address.

After your account has been verified, choose a payment method and fund you account. While doing so, remember that some brokers require new customers to meet specific first-time minimum deposit requirements. Also, check if your chosen payment method has any transaction fees. The latter shouldn’t bug you that much because the brokers recommended here have free deposits.

Lastly, pick a financial instrument, specify a lot size, and place your order. Remember to minimise losses and maximise returns with stop-loss and take-profit orders. Moreover, monitor all your trades in real time whenever possible.

Conclusion

We’ve made your work easier by recommending top forex brokers in Singapore that you can trade with today. Pick a service provider from our list based on your goals and preferences. Remember to deal with a MAS-regulated trading platform to avoid complications like fraud and data theft.

Finally, emotions like greed and frustration can cloud your judgment and cause costly mistakes. Learn to manage your emotions while trading FX pairs.